- TOP

- HIGHLIGHTS

- Highlights of the Current Period

Highlights of the Current Period

Highlights of FY 2023/9

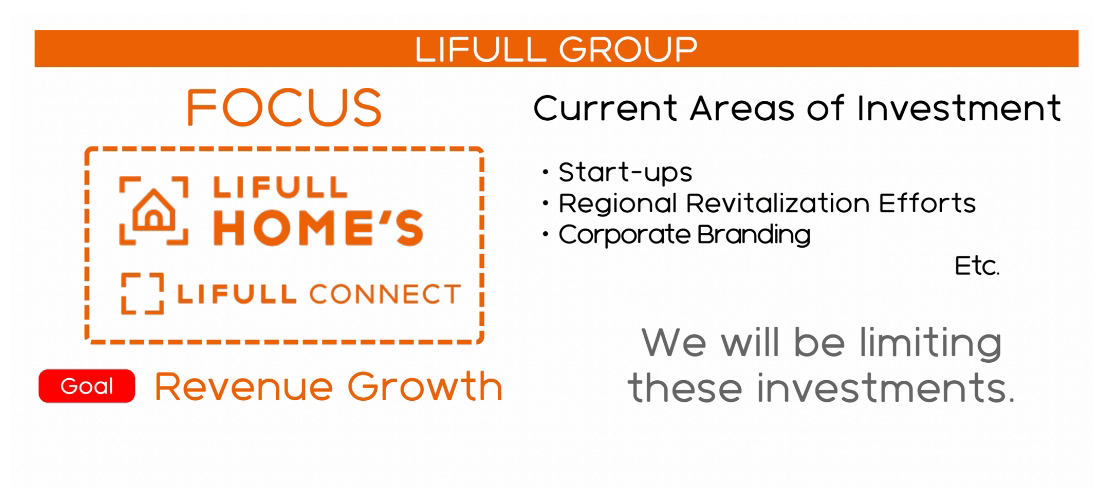

Expansion of our Core Businesses via Selective Focus

In our Mid-Term Management Plan, we aim to achieve the highest operating profit in our history. To reach this milestone, we are following a strategy of focused selection, actively investing in our core businesses, LIFULL HOME'S in Japan and LIFULL CONNECT abroad, to drive revenue growth. By concentrating our resources on these key areas and optimizing our business portfolio, we are working to maximize profitability for the entire Group and, then, reinvesting our profits into these businesses to fuel further growth.

Investing in our Core Businesses

LIFULL HOME'S (HOME'S Services Segment)

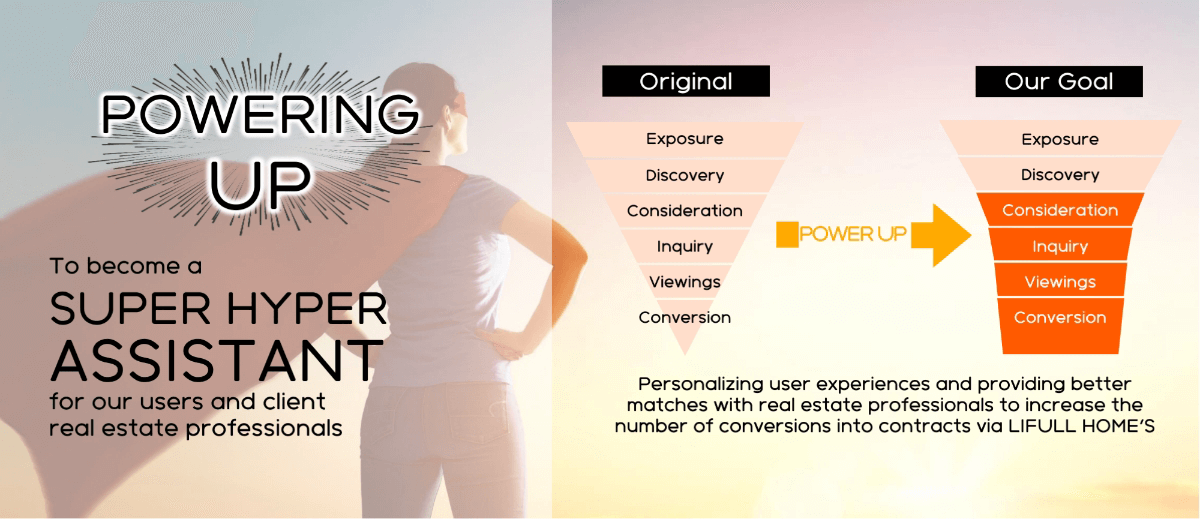

Over the past two years, we have transformed LIFULL HOME'S website and its ancillary services into a Super Hyper Assistant for users and real estate professionals. By leveraging user information, we make it easier for individuals to find their ideal home and help real estate professionals streamline their operations for greater efficiency.

To accelerate this strategy, we established a new department focused on generative AI in May 2023. We are also enhancing the user experience through innovative solutions like the AI Homes-kun Beta chatbot. This chatbot enables users to ask real estate-related questions via LINE and receive personalized listings in a more intuitive search environment. Additionally, we have prioritized the quality of our listings and initiated several collaborations with major real estate management companies to ensure our information is consistently up-to-date and accurate.

Overseas Businesses

Overseas, we are advancing our Moving to Direct strategy in LIFULL CONNECT. This strategy focuses on accelerating business growth by increasing revenue from direct sources such as real estate portals and transaction-related services. We have made notable progress toward this goal through two strategic acquisitions in FY 2023/9.

In Mexico, we acquired Lamudi Mexico, one of the largest real estate portals in the country, and expanded our sales resources there. By leveraging traffic from LIFULL CONNECT's aggregation sites, we aim to further accelerate business growth in Latin America. In Thailand, we acquired FazWaz, a tech-enabled agency that facilitates real estate transactions with various online tools. Given Thailand's fragmented real estate market, consisting of many small-scale professionals, our direct facilitation of transactions between buyers and sellers enables us to expand our business domains to include real estate transactions in this region.

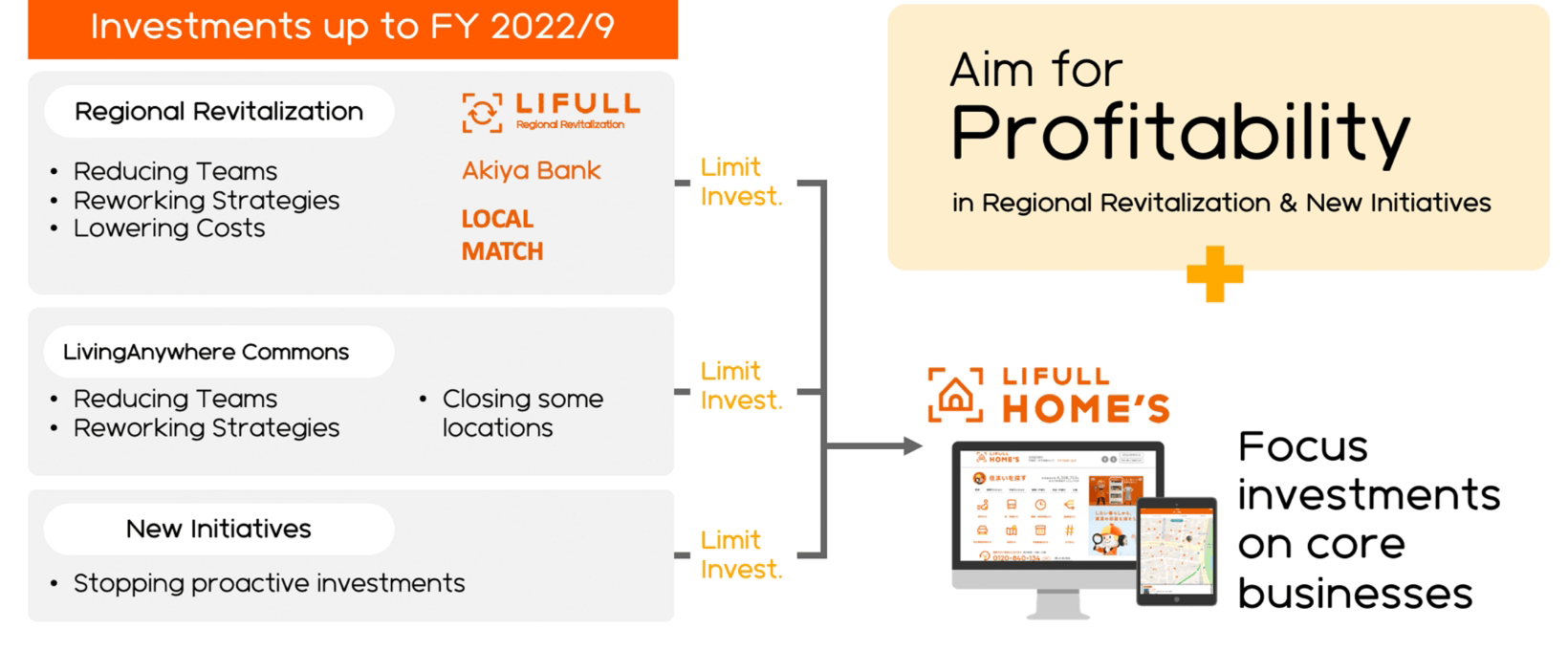

Reduced Investments in Non-Core Services

Regional Revitalization

By addressing the current issue of abandoned houses in Japan, we are bringing more listings to light for LIFULL HOME'S while also creating new opportunities for the Japanese real estate market. In recent years, we have continuously worked to strengthen these initiatives through collaborations with local governments and enterprises. Moving forward, we will continue with these collaborations while reducing the overall scale until we see profitability in the overall business.

Internal Start-Ups

We believe that fostering an environment where employees can start their own businesses is crucial for cultivating the next generation of leaders and expanding the scope of the LIFULL Group. In the past, we have invested in promising business ideas generated through our business pitch competition, SWITCH. While we continue to see new business development as vital to our Corporate Philosophy, we have temporarily paused SWITCH over the past year to concentrate more on growing our core businesses.

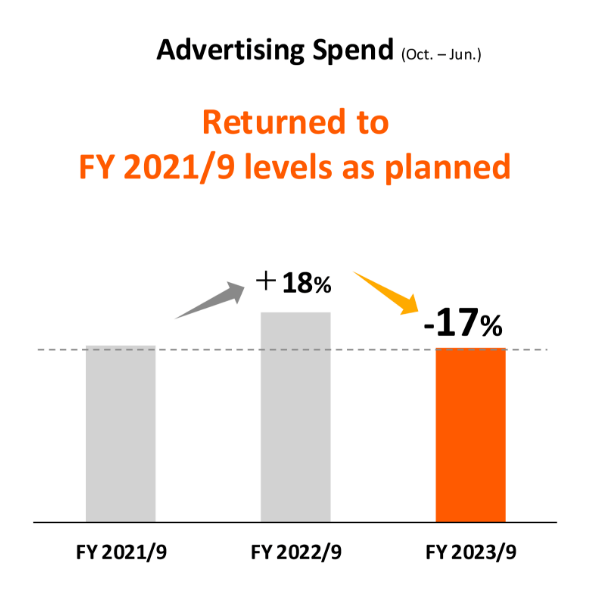

Branding

Since rebranding to LIFULL in 2017, we have enhanced our corporate branding to increase brand recognition and create a more positive image, which we believe will positively impact our revenue. While we continue to see branding as essential for making more users aware of our services, we have shifted our resources from traditional TV commercials to online advertisements and owned media. This adjustment aims to sustain effectiveness while improving cost efficiency.

Reorganization of our Businesses and Subsidiaries

We monitor performance of our subsidiaries and affiliates in bi-monthly management meetings. Through this monitoring process, we are able to quickly identify businesses with limited synergy with our core businesses and make decisions to divest or restructure to ensure which our investments do not meet our expectations.

Examples from Recent Years

LIFULL MOVE (March 2023)

Originally a subsidiary of LIFULL which provided a website to find moving companies. Now, we have absorbed this business to optimize development investments in LIFULL HOME'S.

Kleding B.V. (Fashiola) (August 2022)

Brought into LIFULL with the acquisition of the Mitula Group Limited in 2019. Through this business, we operated fashion aggregation sites mainly in Europe. Despite growth due to increased online shopping during the pandemic, we decided to sell the business due to the limited synergy with the Group's main real estate businesses.

LIFULL Marketing Partners (September 2022)

Acquired in 2015 to strengthen relationships with developers by offering advertising consultation services for the early phases of new projects. Although this business made up a large portion of revenue, the business inherently had a low profit margin, and strategic changes in LIFULL HOME'S led to the sale of this business. While this resulted in decreased in revenue in FY 2023/9, profitability for the segment improved.

Rakuten LIFULL STAY (October 2022)

Together with Rakuten Group Inc., we established Rakuten LIFULL STAY Pte., Ltd. in 2017 to both tap into the opportunities provided by the growing vacation rental markets while also addressing the issues of abandoned houses in rural Japan. The platform created, Vacation STAY, was successful in growing its listings, but changes to legal restrictions related to vacation rentals restricted usage on abandoned houses. Therefore, we made the decision to sell our stake in the company due changes in our Regional Revitalization strategy.

Related Pages