- TOP

- WHO WE ARE

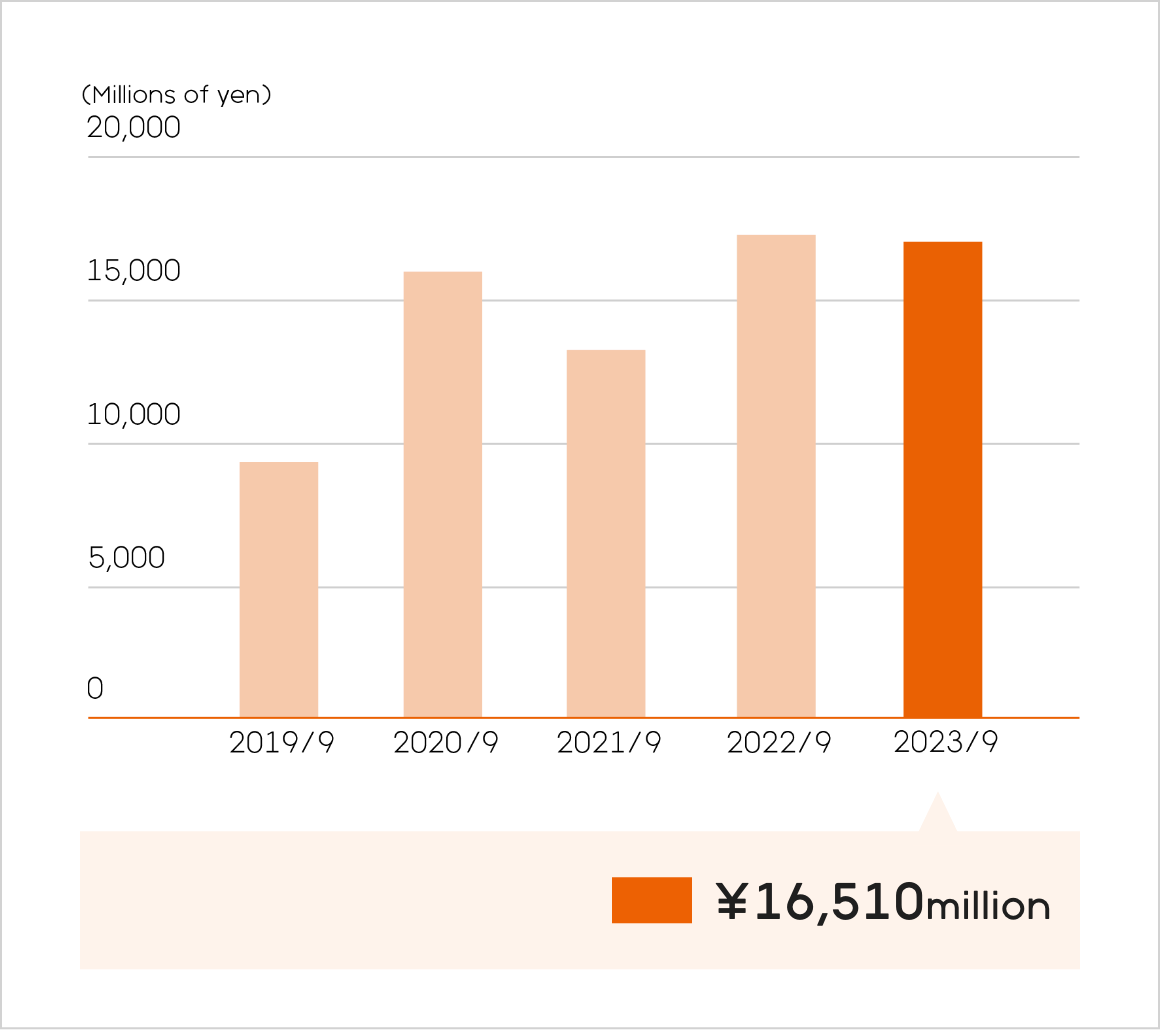

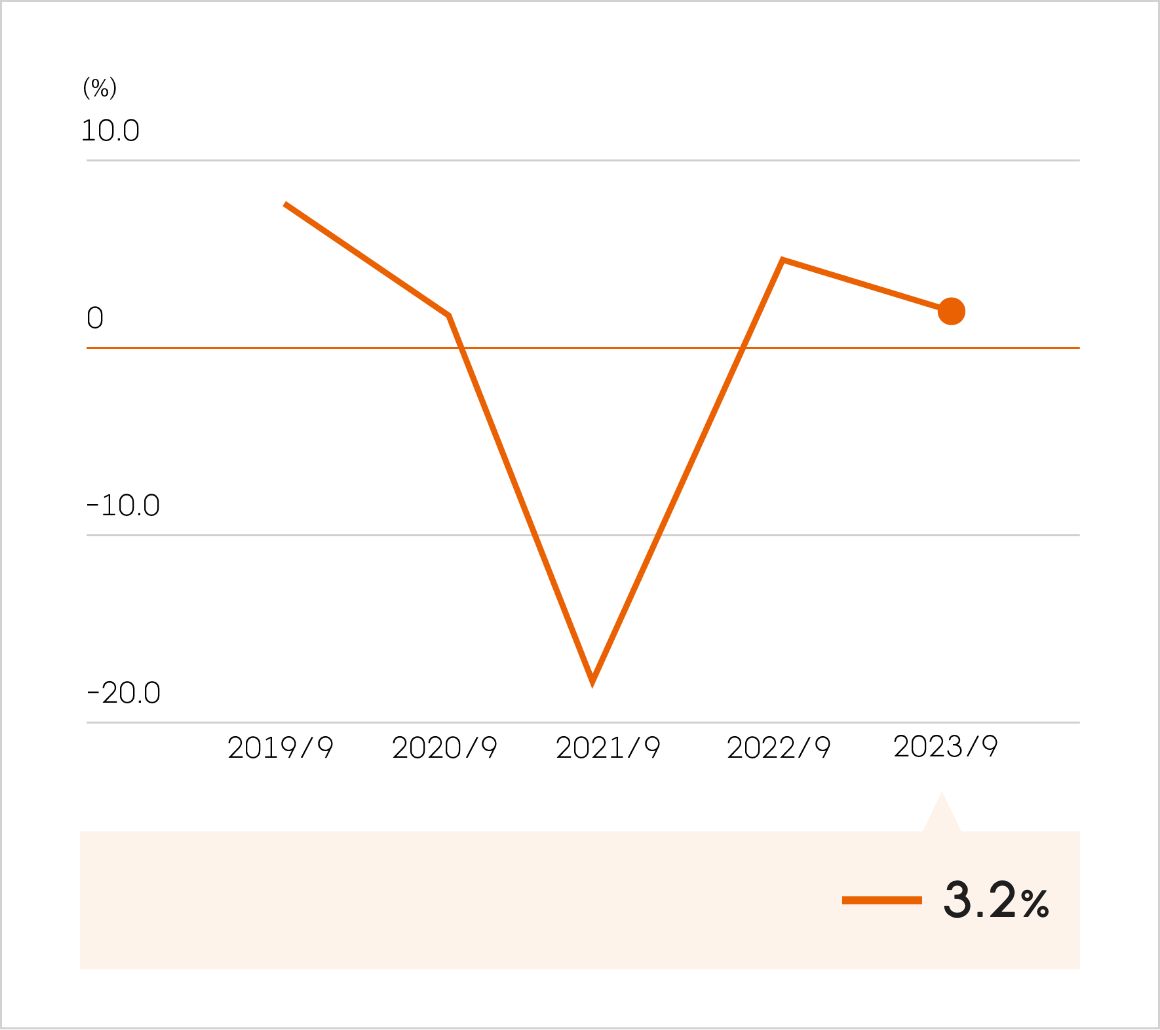

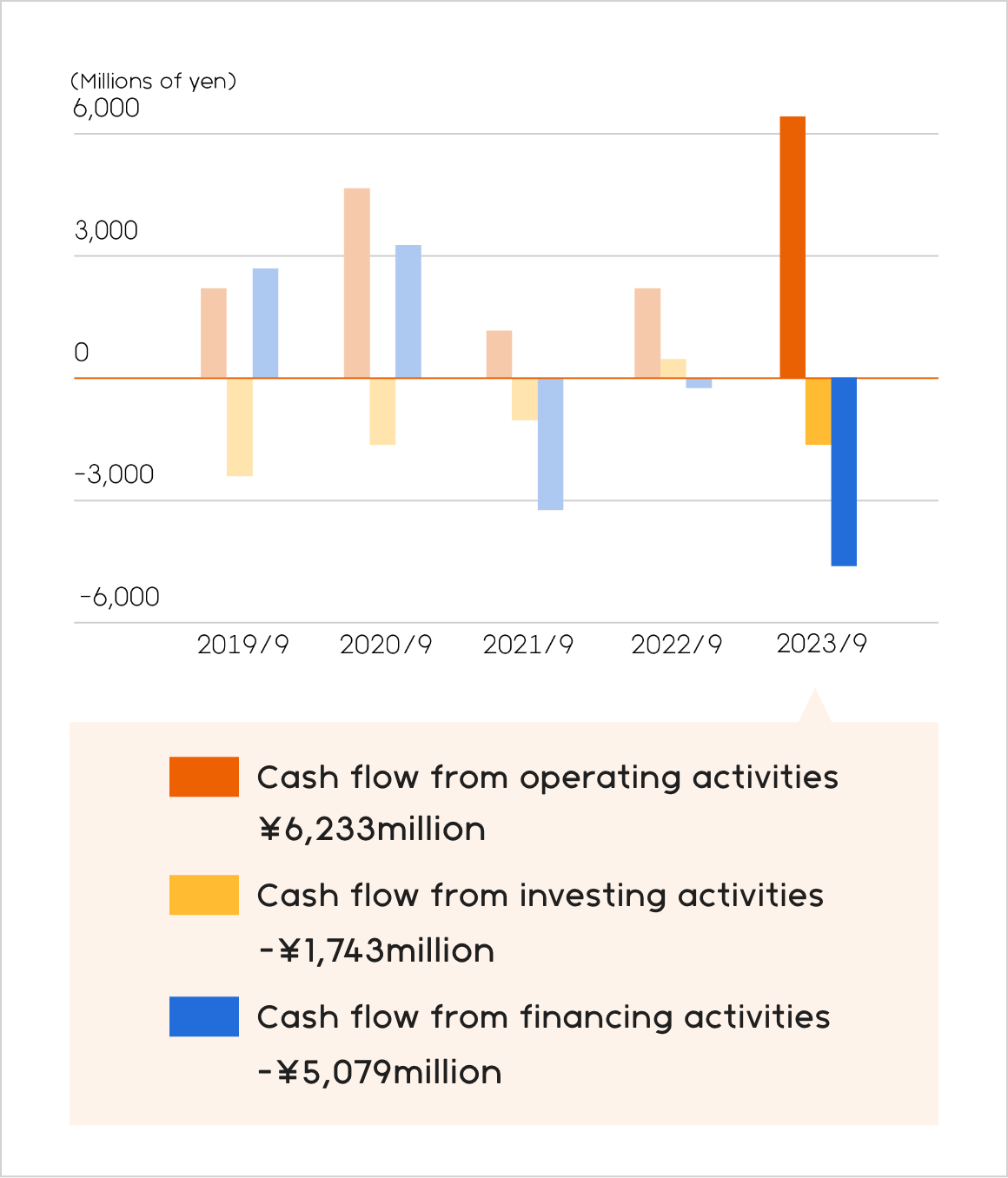

- Performance Highlights for Five Consecutive Fiscal Periods

Performance Highlights for

Five Consecutive Fiscal Periods

Overview of Operating Results for the Fiscal Year Ended September 30, 2023

Overview of Operating Results

During the fiscal year ended September 30, 2023 (October 1, 2022 - September 30, 2023), the economy of Japan began to experience a recovery through a balance between measures against COVID-19 and increased economic activity. However, increased inflation around the world and the weak yen have resulted in higher energy and material costs, which has driven up the cost of living. For these reasons, the future continues to remain partially uncertain.

For the construction and real estate industries, which is the primary industry of our clients, new housing starts have declined about to about 97% of the previous year. At the same time, the market has remained robust with growing volumes of resale property transactions and increasing property prices.

Overseas, countries around the world are being affected by global inflation, monetary tightening and other issues affecting multiple countries which, in turn, have caused stagnation in the real estate and advertising markets.

In this environment, we have also been making proactive investments in the HOME'S Services segment, which includes our flagship real estate information service in Japan, and the Overseas segment for growth in the mid to long term.

In the domestic HOME'S Services segment, we have taken initiatives to strengthen and improve our products and increase our client network to provide more value to users and real estate professionals and increase the competitiveness of our services.

In the Overseas segment, we acquired the tech-enabled real estate company, FazWaz Thailand Co. Ltd. ("FazWaz") in Thailand as well as the operator of Lamudi, one of the largest real estate portals in Mexico, Medios de Clasificados, S. de R. L. de CV ("Lamudi Mexico") thereby increasing our market share in our target markets. FazWaz is over-performing on the original business plans we had set. Therefore, after revising the mid-term business plan, we have added an additional amount to the earn-out.

Additionally, the Regional Revitalization Fund sold two hotel development projects and land for hotel development for one-off gains during the year.

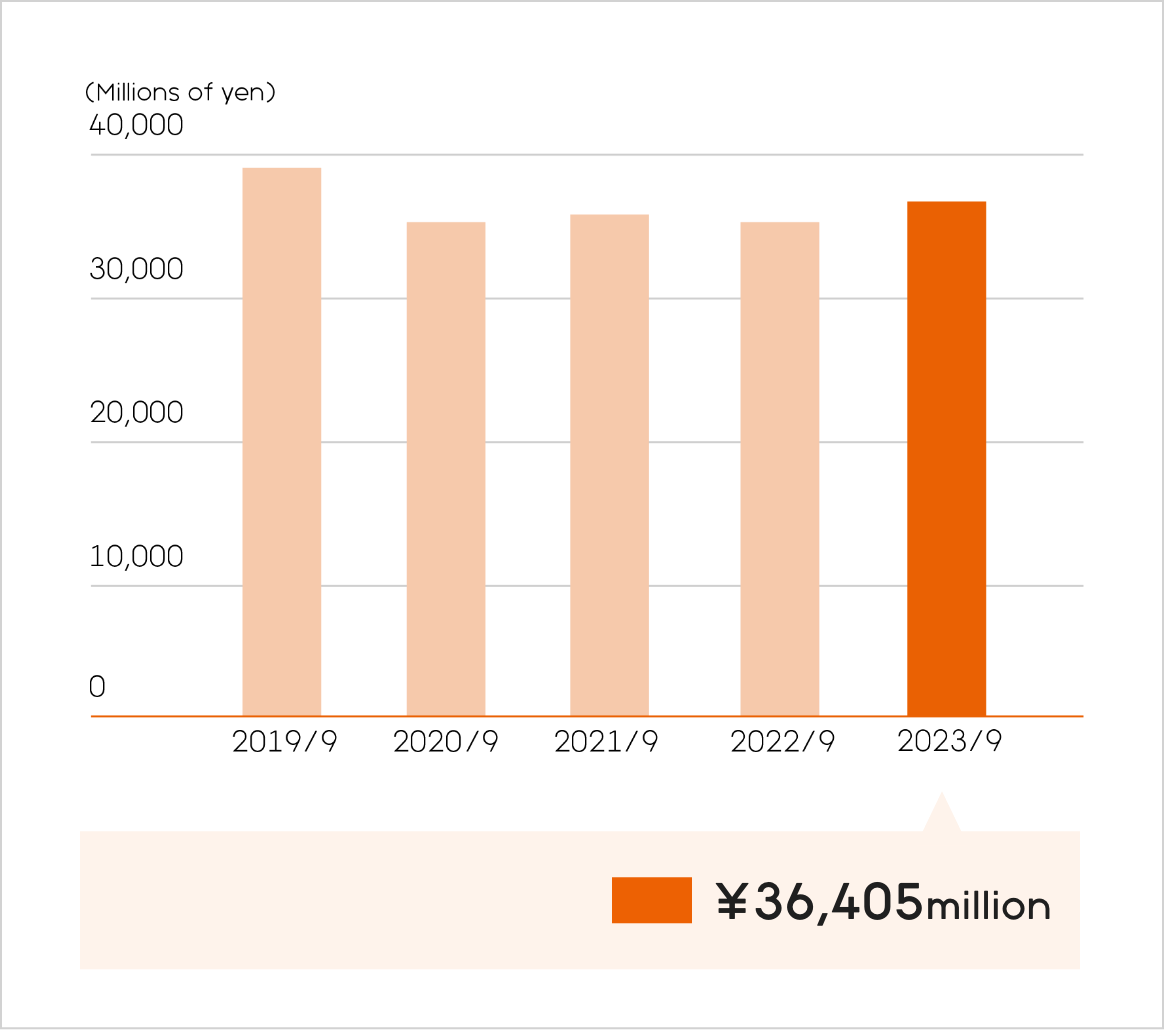

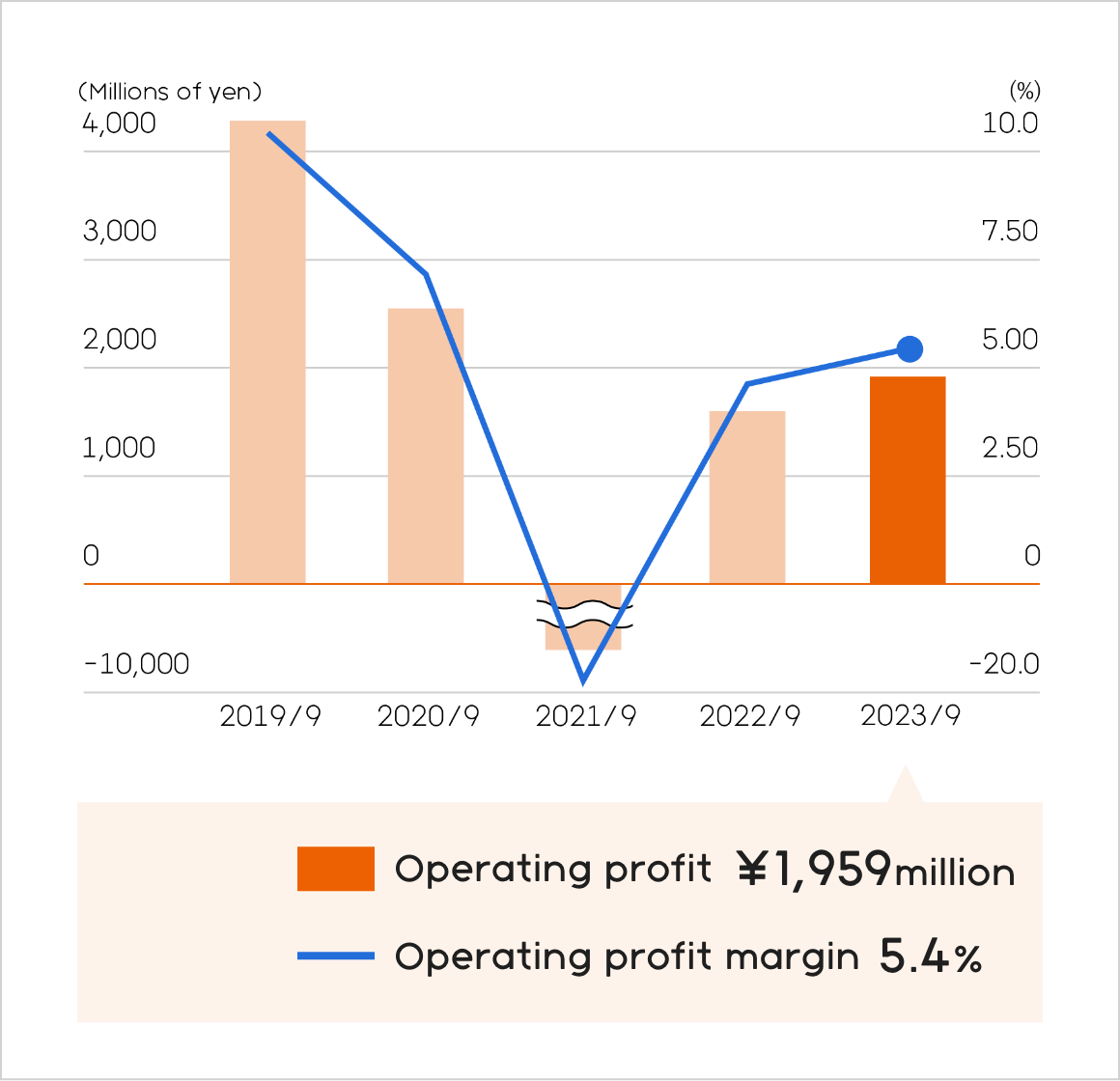

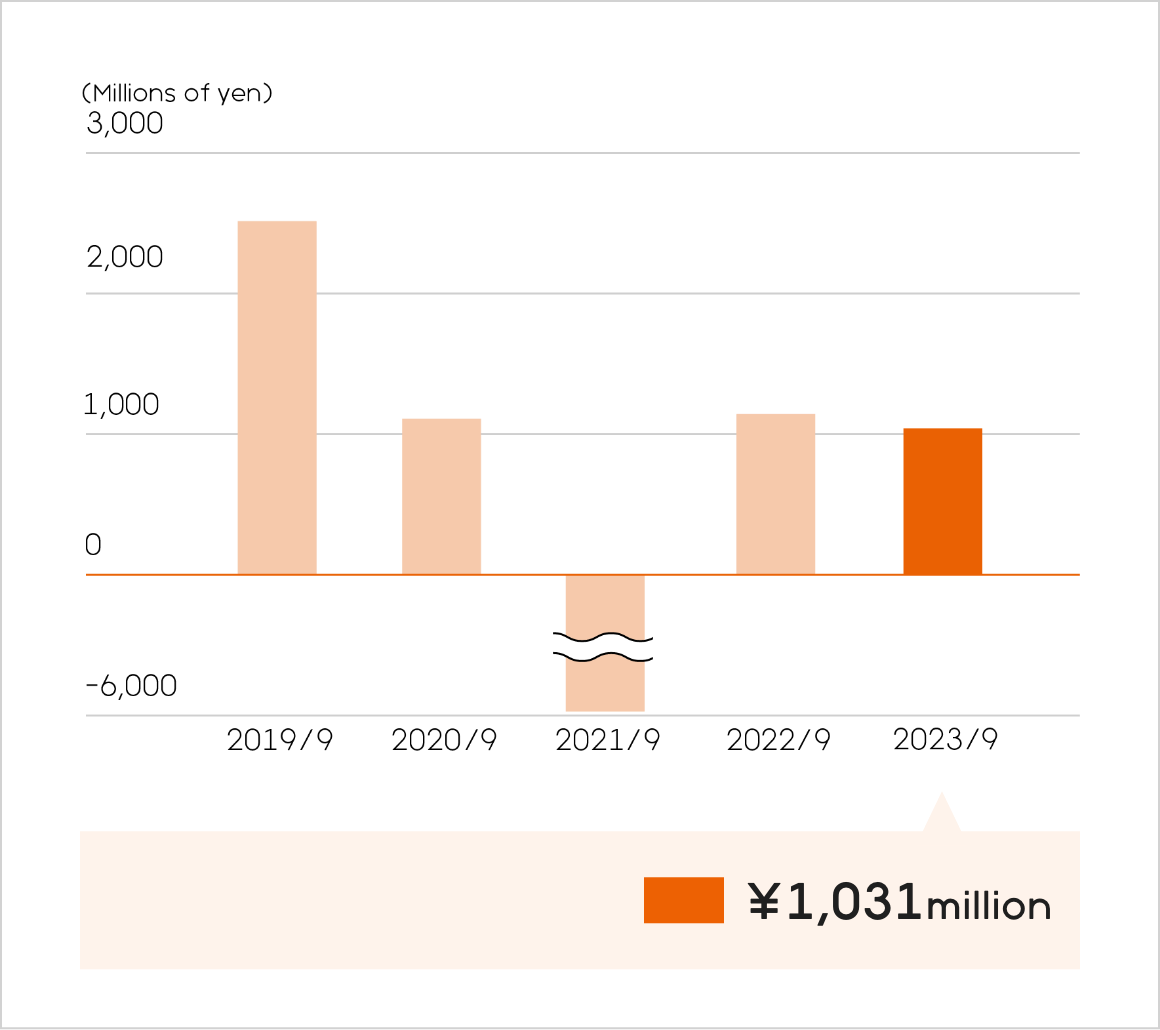

As a result, we ended the period with sales revenue of ¥36,405 million (+1.9% YoY), operating profit of ¥1,959 million (+17.2% YoY), profit for period before taxes of ¥1,634 million (+17.9% YoY), profit for the period of ¥1,055 million (-10.9% YoY) and profit for the period attributable to owners of the parent of ¥1,031 million (-12.6% YoY).

Results by Segment and Region

Revenue by Segment

FY 2023/9

Consolidated Revenue:

¥36.4Bil.

Refer to the following pages for details by business segment.

Revenue Breakdown

- * Calculated based on LIFULL CONNECT management accounting.

- * Regional breakdown was calculated based on client location.

Headcount

- * Regional breakdown based on location of entity to which employees belong.

Highlights for Five Fiscal Periods

Over the past five years, we have expanded our core real estate data services in Japan and internationally through the acquisitions of Trovit and Mitula. In FY 2019/9, we achieved our highest revenue yet, but revenue declined the following year due to the global pandemic and other external factors. To return our businesses to a growth trajectory, we refocused on our core real estate business, investing in LIFULL HOME'S and our international ventures while divesting from ancillary businesses. As a result, we experienced revenue and profit growth in the current fiscal year, indicating a clear recovery trend.

However, impairment losses occurred in 2020 and 2021 due to changes in the valuation standards of overseas businesses. Additionally, profits have fluctuated significantly each fiscal year due to actions such as project sales from the LIFULL Regional Revitalization Fund.

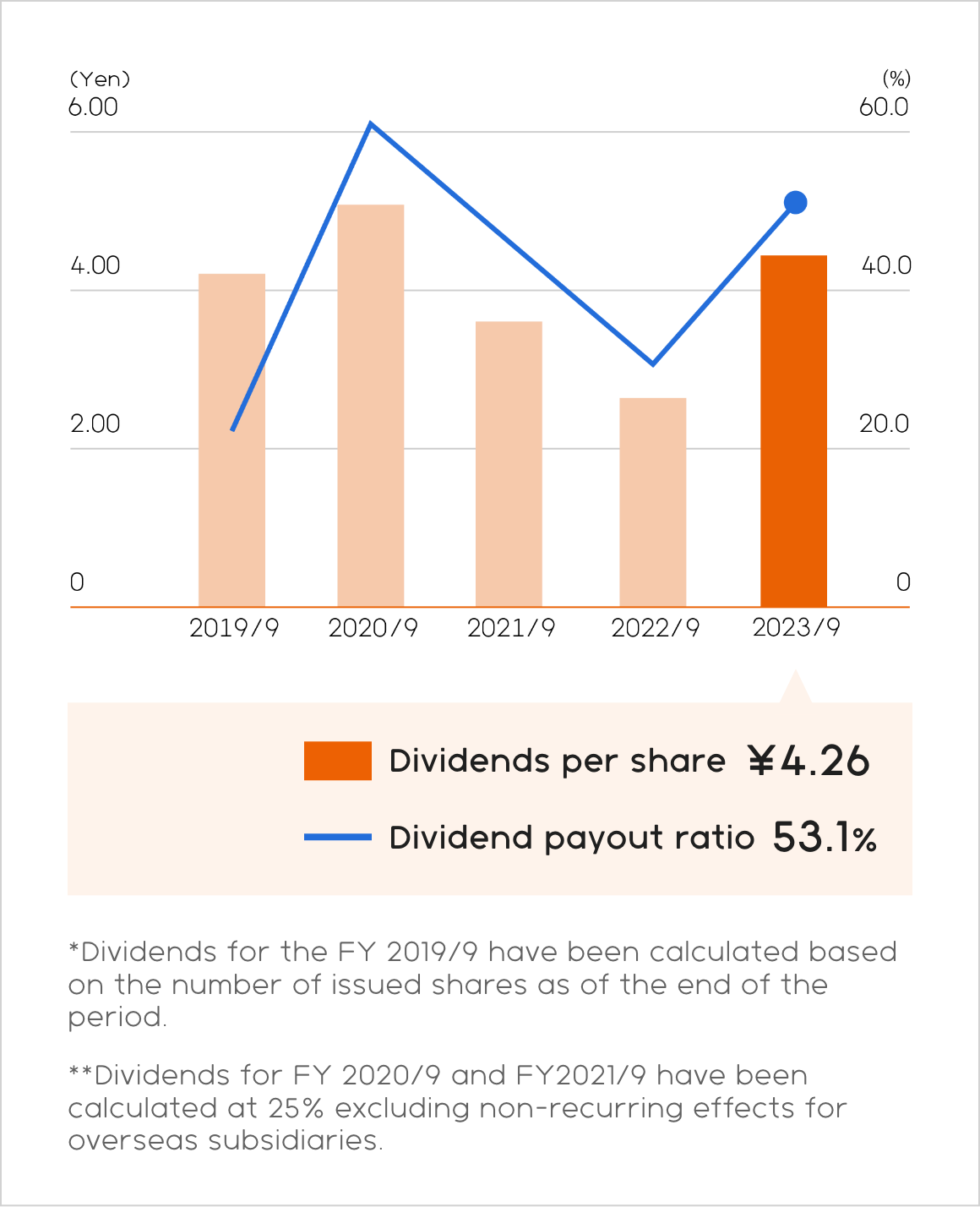

According to our dividend policy, if profit attributable to owners of the parent company fluctuates significantly due to extraordinary circumstances, we strive to exclude these factors from dividend calculations to appropriately return profits to our shareholders. Furthermore, to achieve our Mid-Term Management Plan, ending at the end of FY 2025/9, LIFULL Co., Ltd. has resolved to issue stock options with compensation to its executives and employees.

Revenue

Operating Profit & Margin

Net Profit Attributable to Owners of the Parent

Cash and Cash Equivalents at End of Period

ROE

Cash Flows

Dividends Per Share / Dividend Payout Ratio