Our Mid-Term Management Plan

Mid-Term Management Plan

Developing Our Mid-Term Management Plan

Developmental Process

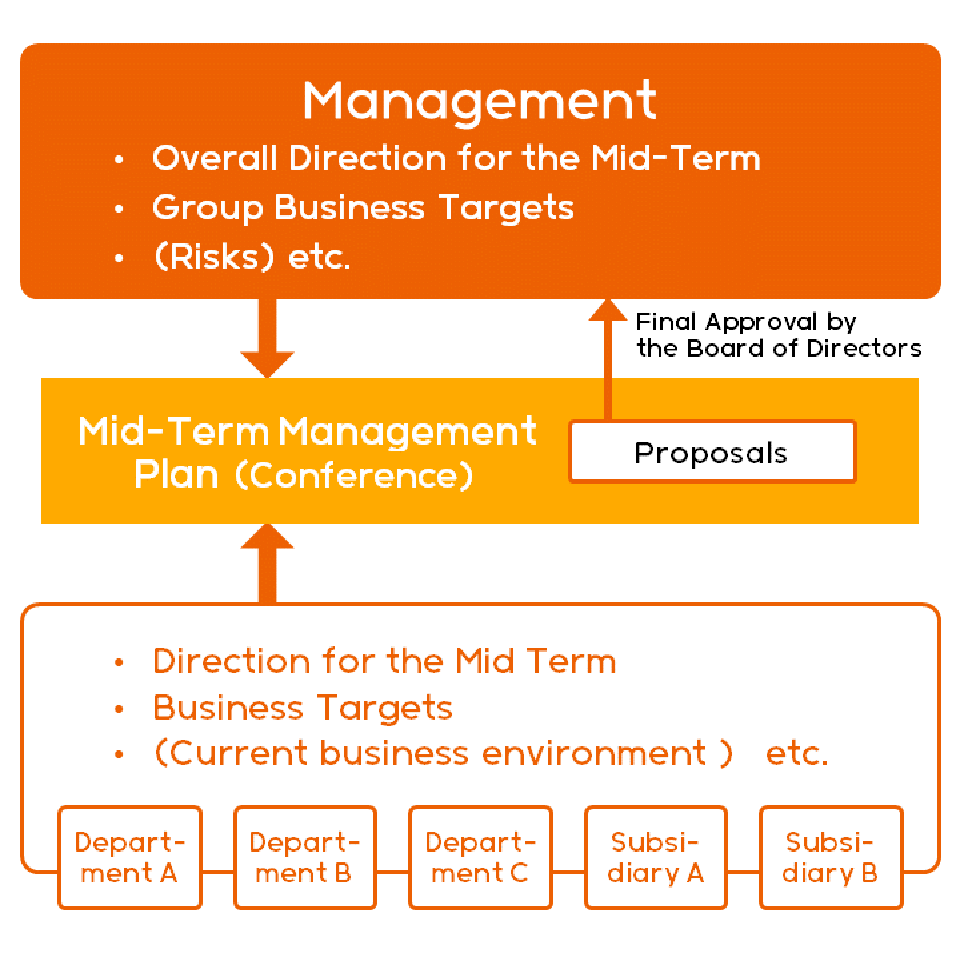

The Mid-Term Management Plan of the LIFULL Group is designed both top down and bottom up in order to include the opinions of as many individuals, both management and employees, as possible.

First, the management of the LIFULL Group holds discussions about the direction that they want to take the Group and share the information within the Group. In the next step, all of the individual departments and subsidiaries create plans to reach the goals set by the management. Finally, after discussions, the Mid-Term Management Plan is finalized and submitted to the Board of Directors for approval.

By ensuring that multiple viewpoints are included throughout this process, employees work more passionately on their individual projects.

Mid-Term Management Plan

Period

FY 2026/9 – FY 2028/9 (3 Years)

Directional Focus

Leveraging AI & Group Synergy to Become the AI Leader in the Housing Sector

Financial Targets (Business Results in FY 2028/9)

Revenue: ¥35.0 – 40.0 Bil.

Operating Profit: ¥5.5 – 6.0 Bil.

Operating Profit Margin: 15+%

Key Focus Areas:

HOME'S Services: Sustain successful strategies to further propel our business expansion

Maximizing Group Synergy: Leverage expertise and resources from LIFULL HOME'S to accelerate overall growth

Achieve Step-Change Growth with AI: Promote the use of (Generative) AI to enhance our services and accelerate our core businesses

Presentation Materials

Leveraging AI and Group Synergy to Become the AI Leader in the Housing Sector

Earnings Presentation IFRS for the Fiscal Year Ended September 30, 2025 and Mid-Term Management Plan:Download(7.7MB)

More details coming soon.

Actions In-Line with our Mid-Term Management Plan

Issuance of a Stock Option

We have issued Stock Acquisition Rights, for consideration (paid issuance), to Full-Time Directors, Managing Officers and employees of unconsolidated LIFULL Co., Ltd. as well as domestic consolidated subsidiaries. The purpose is to further enhance motivation, morale and group solidarity toward achieving our mid-to-long-term business expansion and increasing our overall corporate value.(Release from Nov. 12, 2025)。

| Eligible Parties | Conditions |

|---|---|

| Full-Time Directors and Managing Officers LIFULL Co., Ltd. |

100% Exercisability if Consolidated Operating Profit exceeds ¥6.0 bil. |

| Employees of LIFULL Co., Ltd. Directors and Employees of Domestic Consolidated Subsidiaries |

(a) 50% Exercisability if Consolidated Operating Profit exceeds ¥5.5 bil. (b) 100% Exercisability if Consolidated Operating Profit exceeds ¥6.0 bil. |